What is leadership development?

Named the nation's no. 1 leadership program of its kind five years in a row. Our vision is to be a globally recognized program for leadership development that focuses on making leaders better. One of the centers of the buccino leadership institute, we believe leaders embody the 3 p’s: privilege, purpose, and passion. Read more of the message from the director ». Gri’s business leadership forums (blfs) facilitate collaboration between companies and stakeholders through active engagement and peer learning, leveraging thought leadership to help find solutions for impactful sustainability reporting. Our blfs bring sustainability experts and stakeholders together and focus on current issues and challenges, actively responding to the needs of the gri community members. Gri has been running leadership groups and forums since 2015, inspiring corporate and stakeholder collaboration and focusing on a diverse range of sustainability reporting trends and challenges, which include digital as well as integrated reporting, conflict minerals, circular economy, and the sustainable development goals (sdgs). We have also partnered with other leading organizations, such as the international integrated reporting council (iirc), the united nations global compact (ungc), pwc, the responsible minerals initiative (rmi), the responsible labor initiative (rli) and many more, to deliver the most impactful

read more →

Start and grow your business

U. S. Small business administration (sba) the u. S. Small business administration (sba) provides financial, technical and management assistance to help americans start, run and grow their businesses. Score is a resource partner with the sba. The sba administers a congressional grant which provides score with funding. Score volunteers work with the sba to provide small business mentoring and training to entrepreneurs through sba offices. The sba offers programs and services for start-ups, established and growing businesses across north dakota. Nd district office 657 second avenue north, room 360 po box 3086 fargo, nd 58108-3086 701. 239. 5131 tdd: 800. 877. 8339 bismarck satellite office 1200 memorial hwy. Bismarck, nd 58504 701. 250. 4303 800. 544. 4674 grand forks satellite office 102 n 4th st. Suite 104 grand forks, nd 58203 701. 746. 5160. Us small business administration, miami miami is home to an office of the us small business administration. The sba offers information on small business loans, grants, bonds and other financial assistance. While sba does not make loans directly, you can find a local lender who can help you with your loan application. You may also speak directly with a local sba representative by calling 305-536-5521. Miami-dade office

read more →

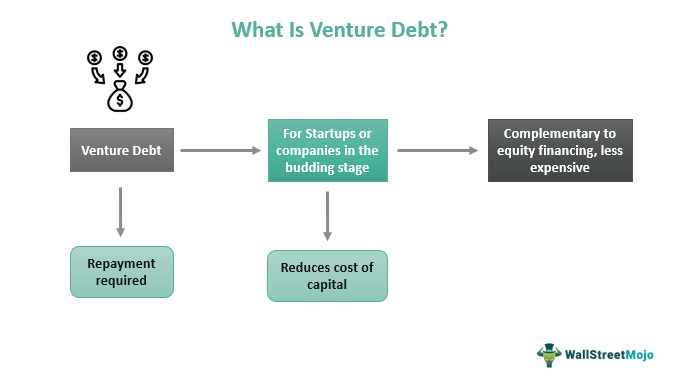

Venture Debt Financing: What Is It, and How Does It Work?

Venture debt, also known as venture lending, is a smart and critical source of financing for today’s entrepreneurial companies. It’s a type of financing that is offered to growth-stage venture capital-backed companies and allows a company to raise additional capital to supplement their equity financing and continue to fuel their growth trajectories. Venture capital is typically the first source of institutional financing for startup companies. With strong venture capital investors, a technology bank lender will typically provide a term loan and/or receivables financing. Venture debt from trinity compliments both forms of financing and provides significant value to startup companies, venture capital firms, and technology bank lenders. However, it’s doing so “less aggressively than in the past,” says writer yuliya chernova. Svb’s moves are ‘contributing to a sharply decelerating venture-debt market, which means there are fewer sources of financing at the very time more startups are struggling,” the report says. In an wsj newsletter, svb’s pace of lending is not good for the startup and venture sector. “the economy and the fundraising environment are headwinds on loan origination,” said marc cadieux, a 30-year-veteran of svb who was named president of its commercial banking division in june. “fewer companies are able

read more →

Personal loans and business credit cards

Qualifying for a business loan through kapitus is easier than you think! depending on the amount you are looking to secure, there are minimum criteria that you must meet (perfect credit not required!), including: you must have a personal credit score of at least 625. Your business needs to have been operating for at least two years. You need to have a minimum of $250,000 in annual revenue. Kapitus financing products vary by state, so business loans may not be available to everyone. Not to worry! we have a product for every business in every state. Please contact a kapitus financing specialist to discuss your particular circumstances. 1 a loan applicant may be eligible for an interest rate discount of 0. 25% or 0. 50% on small business loans and small business lines of credit. The interest rate discount is based on the dynamic business checking – deposit balance tier benefits in effect on the loan application date. If you are in the core rewards tier benefit on the loan application date, you are not eligible for an interest rate discount. Loan applicants in the plus rewards tier, on the loan application date, are eligible for a 0. 25% interest

read more →What Is Capital Investment?

Capital investment is a broad term that can be defined in two distinct ways: an individual, a venture capital group or a financial institution may make a capital investment in a business. The money can be provided as a loan or a share of the profits down the road. In this sense of the word, capital means cash. The executives of a company may make a capital investment in the business. They buy long-term assets such as equipment that will help the company run more efficiently or grow faster. In this sense, capital means physical assets. In either case, the money for capital investment must come from somewhere. Investment capital is the money used to acquire plants, equipment, and other items needed to build products or offer services. Investment capital is also referred to as financial capital. Established by the consolidated appropriations act, 2021, the emergency capital investment program (ecip) was created to encourage low- and moderate-income community financial institutions to augment their efforts to support small businesses and consumers in their communities. Under the program, treasury will provide up to $9 billion in capital directly to depository institutions that are certified community development financial institutions

read more →

How to get a small business loan

The paycheck protection program (ppp) ended on may 31, 2021. It offered loans to help small businesses and non-profits keep their workers employed. If you follow the guidelines, your loan may be forgiven. Learn about the sba's paycheck protection program , including program details and frequently asked questions. Established by the small business jobs act of 2010 (the act), the small business lending fund (sblf) is a dedicated fund designed to provide capital to qualified community banks and community development loan funds (cdlfs) in order to encourage small business lending. The purpose of the sblf is to encourage main street banks and small businesses to work together, help create jobs, and promote economic growth in communities across the nation. Treasury invested over $4. 0 billion in 332 institutions through the sblf program. These amounts include investments of $3. 9 billion in 281 community banks and $104 million in 51 cdlfs. Finding a loan that is a perfect match for your small business is a challenging process. These steps will help you choose the perfect option with the best small business loan terms. 1. Make sure you know what your credit score is 2. Find different lenders that offer the amount

read more →